Back in my youth, money was my second favorite thing—right after my mom, of course!

Who knew I could love something that didn’t even hug me back?

I have always aspired to be the child in the colony who arrives with a golden spoon, causing others to question whether I am really good at Monopoly or if I am secretly a royal.

But you know what?

I always end up splurging on stuff I never even wanted in the first place! It’s like my wallet has a mind of its own, and it just loves to throw money at random things.

At this point, I began to notice the not-so-subtle hints that financial literacy might actually matter.

Who knew money management could be a thing!

What is Financial Literacy?

Financial literacy refers to the knowledge and skills needed to make informed financial decisions.

It includes understanding topics such as budgeting, saving, investing, and managing debt. Developing financial literacy can help individuals make better choices with their money and ultimately improve their overall financial well-being.

Financial literacy is not just about saving a few bucks here and there. It’s about understanding where your money’s going so you don’t wake up one day wondering why you’re broke after buying 15 things you don’t even like.

Trust me, I’ve been there.

And along with me, over 60% of young adults don’t know how to handle money properly.

And guess what?

Nearly half of us end up living paycheck to paycheck, even though we don’t have major expenses like a mortgage yet.

Importance of Financial Literacy

According to a 2023 survey by the Reserve Bank of India (RBI), less than one-third of Indians are financially literate, with only about 27% of adults meeting the minimum criteria for financial literacy.

Therefore, it becomes really important for students and youth to understand the concept of money at a young age so that they can make informed decisions and avoid financial struggles in the future.

- Helps in Better Money Management

Financial literacy equips young people with the knowledge to manage their money wisely. Understanding budgeting, saving, and spending ensures that one can handle their personal finances effectively, avoiding unnecessary debt. Knowing how to create and stick to a budget helps in controlling spending, which is crucial for long-term financial stability. - Prevents Debt Accumulation

One of the key challenges young adults and students face is managing student loans, credit cards, and other forms of debt. Financial literacy teaches them how loans work, including interest rates and repayment plans, which helps them make better borrowing decisions. In fact, 52% of Indian youth often struggle with debt due to lack of knowledge on how to handle it. - Encourages Saving Habits

Developing saving habits early in life leads to long-term financial well-being. Financial literacy helps youth understand the importance of setting aside money for emergencies and future goals. This habit promotes disciplined saving and financial security, preparing them for unforeseen circumstances. - Increases Financial Independence

Financial literacy fosters independence among youth, allowing them to make informed decisions without relying on others. They learn to analyze financial products like insurance, investments, and loans on their own, helping them become self-sufficient and responsible for their economic futures. - Improves Decision-Making Skills

Being financially literate enables youth to make sound financial decisions. Whether it’s deciding on education loans, investments, or managing expenses, financial literacy ensures they can weigh options, understand risks, and choose wisely. - Prepares for Future Investments

Financial literacy isn’t just about managing everyday expenses. It’s also about learning how to grow wealth through investments. Youth who are financially educated are more likely to invest in stocks, mutual funds, or real estate, which can provide long-term financial gains and help in wealth accumulation. - Builds Financial Confidence

With financial literacy comes confidence. Youth who understand financial concepts are more confident in managing their money and navigating financial challenges. This confidence reduces stress and anxiety related to finances, especially during major life transitions such as entering college or starting a job.

If you want to be financially secure, the first step is to learn the basics of personal finance management.

What is Financial Management?

Financial management refers to the strategic planning, organizing, directing, and controlling of financial activities within an individual’s or organization’s resources. It involves budgeting, saving, investing, and managing debt to achieve financial goals and stability.

For students and young adults, understanding the basics of financial management is critical because this is when they often begin to handle money independently.

Here are the key concepts students should understand:

Budgeting: Creating a plan to manage income and expenses. Students can allocate their earnings, allowances, or loan money toward necessities like housing, food, and books, while also setting aside money for entertainment and emergencies. This prevents overspending and helps ensure that they don’t run out of money before their next source of income.

Saving: Setting aside money regularly for future use, which could be for emergencies, larger purchases, or even post-college life. Students should prioritize saving at least a small portion of their income regularly. A good goal is the 50/30/20 rule: 50% on needs, 30% on wants, and 20% on savings.

Debt: Understanding debt, such as student loans or credit card debt, is crucial. Students should be aware of interest rates, payment schedules, and the long-term implications of borrowing money. It’s important to distinguish between good debt (e.g., student loans) and bad debt (e.g., high-interest credit card debt).

Investing: While it may seem advanced for students, basic knowledge of investing can set them up for future financial success. This includes understanding stocks, bonds, and how compound interest works in investment accounts, which could help them grow wealth in the long run.

Now that we understand the basic terms of financial management and recognize the importance of having a solid foundation in financial literacy, the next step is to set up financial goals for the future.

Setting Financial Goals in College and Beyond

Setting financial goals is a vital skill for students that helps them manage immediate and long-term financial responsibilities.

Whether you are paying for daily expenses like meals and textbooks or thinking about future obligations like student loan repayments and career savings, setting clear financial goals is essential.

Short-Term Goals

Short-term goals refer to immediate needs and expenses students will face in the coming months.

These can include:

- Paying for textbooks and supplies.

- Covering daily costs like food, transportation, and entertainment.

- Managing social activities and extracurricular expenses without overspending.

Long-Term Goals

Long-term financial goals involve thinking ahead.

Examples include:

- Paying off student loans after graduation.

- Saving for an emergency fund.

- Planning for post-college life, such as finding a job or renting an apartment.

The best way to balance short term and long term goals is to create a budget that allocates funds for both immediate needs and future aspirations.

Using the SMART criteria is one of the best ways to strike a balance between these objectives.

How to Set SMART Financial Goals

Students should learn how to set SMART goals—Specific, Measurable, Achievable, Relevant, and Time-bound.

For example:

- Specific: “I want to save ₹5,000 for a summer internship by June.”

- Measurable: Keep track of your savings progress.

- Achievable: Ensure that this amount is realistic within the given timeframe.

- Relevant: Make sure the goal aligns with your overall financial picture and future plans.

- Time-bound: Set a clear deadline, such as saving the amount by June.

Note: It is important to regularly review and adjust these goals as circumstances change to ensure continued progress towards financial stability.

Budget Planning

After you’ve established your financial goals, the next step is to create a practical and doable budget that will help you reach those goals.

Many students are unaware of the concept of budget.

What is budget planning?

Budget planning is the process of outlining your income and expenses to ensure that you are able to meet your financial goals. It involves carefully tracking and managing your spending in order to allocate funds towards savings, debt repayment, and other financial priorities.

By creating a budget, you can gain better control over your finances and work towards achieving long-term financial stability.

Budget planning is really important for students. It helps them keep track of their spending and avoid getting into debt they don’t need. It helps students focus on their financial goals and make smart choices about how they spend their money.

Since we’re on the topic of budgeting, I want to share a really common and important rule that many people follow when they want to take charge of their finances.

The 50/30/20 Budget Rule

The 50/30/20 budget rule is a popular guideline that suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings or debt repayment.

As you’re a young adult with fewer financial obligations, let’s discuss this rule in a way that makes sense for you.

- 50% for Needs: Half of the student’s income should go toward essential living expenses—things that are necessary for survival. These include rent, groceries, utilities, transportation, and basic study materials. For example, if a student earns ₹20,000 per month, ₹10,000 should be allocated to cover these essential costs. This ensures that the student’s most important financial responsibilities are prioritized.

- 30% for Wants: This category is for non-essential but enjoyable spending. About 30% of a student’s income should go toward entertainment, dining out, shopping, or hobbies. Using the ₹20,000 income example, ₹6,000 could be reserved for these discretionary expenses. This part of the budget allows students to enjoy life without overspending.

- 20% for Savings/Debt Repayment: The remaining 20% should be used for building savings or paying off any debt. For students, this could mean saving for an emergency fund, future tuition, or long-term goals like a trip or starting investments. For those with loans, part of this money can be allocated to repay debt, building good financial habits early.

We now understand that budget planning is important; let’s go ahead and plan your first budget together.

Step-By-Step Guide in Building Your First Budget

Step 1: Calculate Your Income

Before you can create a budget, you need to understand where your money is coming from.

For students, income can come from a variety of sources:

- Part-time jobs: If you work while studying, your monthly wages will form the core of your income.

- Scholarships and Grants: These can be large one-time payments or smaller, recurring amounts.

- Allowance from Parents: Many students rely on regular financial support from family.

- Student Loans: While technically debt, student loans might be used for living expenses during school.

Total all your income sources for the month.

For example, if you make ₹10,000 from a part-time job, get ₹3,000 as a stipend from a scholarship, and receive ₹7,000 from your parents, your total monthly income would be ₹20,000.

Pro Tip: Use budgeting apps like Mint or YNAB (You Need a Budget) to easily track your income.

Step 2: List Your Expenses

Once you know your income, the next step is to list all your monthly expenses. Be thorough in including every possible expenditure.

- Fixed Costs: These are regular, consistent expenses you can’t avoid:

- Rent

- Utilities (electricity, water, etc.)

- Transportation (public transport, fuel, etc.)

- Internet and phone bills

- Subscriptions (Spotify, Netflix, etc.)

- Variable Costs: These expenses change from month to month:

- Groceries

- Dining out

- Entertainment (movies, concerts, etc.)

- Social activities

- Textbooks and supplies

- Irregular Costs: Expenses that don’t happen every month but need to be accounted for:

- Medical bills

- Annual subscriptions or memberships

- Clothes shopping

Keep a record of these expenses using spreadsheets or budgeting apps, and regularly update them.

Step 3: Apply the 50/30/20 Rule

The 50/30/20 rule is a simple and effective way to allocate your income to cover your expenses, savings, and discretionary spending.

- 50% for Needs: These are essential living expenses. About half of your total monthly income should go toward necessities like rent, groceries, utilities, transportation, and healthcare.

For example, if your monthly income is ₹20,000, ₹10,000 should be reserved for these fixed and necessary expenses. You might spend ₹5,000 on rent, ₹3,000 on groceries, and ₹2,000 on utilities. - 30% for Wants: This is for non-essential expenses, like eating out, going to the movies, or buying clothes. This portion of your budget allows for flexibility and fun, without going overboard.

If you allocate 30% of ₹20,000, you’ll have ₹6,000 to spend on dining out, entertainment, hobbies, and anything else that isn’t a “need.” You could go to a restaurant twice a month or spend on occasional trips and socializing. - 20% for Savings/Debt Repayment: The last portion should be allocated toward saving for future needs or paying off debt (like student loans or credit card balances). Savings can include setting aside money for an emergency fund, post-college expenses, or even long-term goals like investing.

With ₹20,000 as monthly income, ₹4,000 should go into savings or debt repayment. You could open a Recurring Deposit (RD) or invest in a Systematic Investment Plan (SIP) for consistent savings.

Step 4: Track Your Spending

Creating a budget is only the first step; sticking to it is what really counts.

Tracking your spending ensures you know where your money is going and helps avoid overspending.

- Tracking Tools: Use budgeting apps or spreadsheets to track all your spending. Many banks also provide online tools to categorize your transactions and monitor your budget.

- Review Weekly or Monthly: At the end of each week or month, review your spending to see if you stayed within your budget. Adjust your spending habits accordingly if you find you’re overspending on “wants.”

Tracking your expenses may reveal areas where you can cut back.

For example, if you notice that you spend ₹2,500 on dining out, you can challenge yourself to cut it down to ₹1,500 by cooking more at home.

Step 5: Set Financial Goals

Your budget will be more effective if you have specific financial goals in mind.

This can include:

- Short-term Goals: Saving for a summer trip, buying a new laptop, or building an emergency fund.

- Long-term Goals: Paying off student loans, saving for post-college life, or even investing in stocks.

Write down these goals and assign specific amounts you need to save each month.

For example, if you want to save ₹15,000 by the end of the year for any gadget or project, you can divide this over 12 months and set aside ₹1,250 per month.

Step 6: Review and Adjust

Budgets aren’t static.

Life changes, expenses come up, and sometimes income fluctuates.

Reviewing your budget regularly allows you to make necessary adjustments.

If you find you’re overspending in one area, try to cut back in another.

If you get a raise or an additional income source, allocate it wisely between savings, debt repayment, and discretionary spending.

Pro tip: Have a monthly review checklist that would help you track your financial progress and make necessary changes to your budget.

Note: A well-structured budget helps avoid overspending, save for emergencies, and reduce financial stress.

Also read: Top 7 Time Management Hacks for Students

We’ve come across terms like daily expenses, needs and wants, and saving for emergencies and the future in the budgeting steps.

Let’s chat about them in the next section!

Managing Daily Expenses and Cutting Costs

Students often struggle to track where their money goes, especially when they are balancing academic responsibilities and personal finances. Learning to manage daily expenses effectively can make a big difference in saving money and avoiding debt.

How to Track Daily Spending

Tracking daily expenses is key to managing money. Here are some tools students can use:

- Apps: Many budgeting apps like Mint, YNAB (You Need A Budget), or Student Loan Hero help students monitor their daily expenses and categorize spending.

- Spreadsheets: Simple Google Sheets or Excel templates can be used to manually enter income and expenses each day, allowing students to see their financial habits in real time.

- Notebooks: If digital tools aren’t appealing, students can simply write down their daily expenses in a notebook, noting each purchase and categorizing them as “needs” or “wants.”

Simple Ways to Save on Daily Expenses

- Meals: Students can save money by meal prepping and cooking at home instead of eating out frequently. Cooking in bulk and packing lunches for the day is often much cheaper than buying individual meals.

- Transportation: Walking, biking, or using public transportation can reduce costs while avoiding unnecessary expenses like ride-shares or cabs.

- Entertainment: Finding free or student-discounted entertainment options, such as movie nights, campus events, or subscription sharing with roommates, can reduce costs.

Also read: Impact of Social Media on Students

The Reality of Financial Discipline

Managing your expenses sheds light on the realm of financial discipline.

What is Financial Discipline?

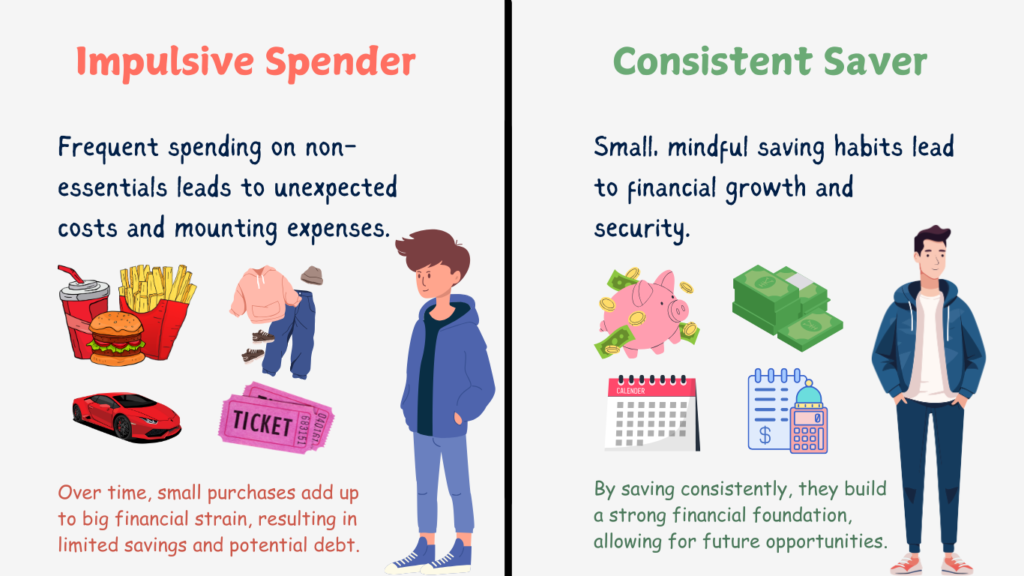

Financial discipline is the ability to manage your money responsibly over time by sticking to a budget, setting realistic financial goals, and resisting impulsive spending.

For students, financial discipline is the cornerstone of long-term financial success, as it builds a foundation for achieving goals such as saving for future education, paying off student loans, or even purchasing a first home.

Advantages of Building Financial Discipline

1. Building Long-Term Habits

Developing self-discipline with money teaches students crucial habits that carry into adulthood.

When students learn to budget, save, and prioritize needs over wants, they are preparing themselves for financial independence.

This isn’t just about managing day-to-day expenses but about shaping their relationship with money for years to come. It teaches them delayed gratification—a key skill in reaching long-term financial goals.

Example: Instead of spending on frequent entertainment, disciplined students might decide to save for a future internship or international study program that will add long-term value to their career.

2. Achieving Financial Goals

Financial goals, whether short-term like saving for textbooks or long-term like paying off student loans, require discipline to achieve.

Without the ability to manage money consistently, goals can easily fall by the wayside.

Financial discipline encourages students to stick to their savings and investment plans, helping them meet major milestones with less stress.

Example: A student practicing financial discipline might set aside a specific amount each month from their part-time job or allowance, gradually building their emergency fund or saving for post-graduation plans.

3. Avoiding Debt and Financial Stress

One of the greatest benefits of financial discipline is avoiding unnecessary debt.

Many students fall into the trap of relying on credit cards for non-essential spending, leading to accumulated debt that can spiral out of control.

Learning to practice discipline early on helps students manage debt wisely and avoid unnecessary financial stress in the future.

Example: A student with financial discipline would understand the difference between using a credit card for emergencies versus using it for impulsive purchases like eating out or buying gadgets.

4. The Role of Self-Control

There are frequent opportunities for students to spend money, from social gatherings to the most recent gadgets.

Financial discipline equips them with the self-control necessary to make informed spending decisions.

Learning to say no to non-essential purchases, or delaying gratification, helps students prioritize their needs and long-term goals.

The Principle of Need v/s Want

One of the most important lessons in managing daily expenses is understanding the difference between needs and wants.

Needs : Needs are essential items or services that are necessary for survival and well-being, such as food, shelter, and healthcare.

Wants: On the other hand, wants are non-essential items or services that are nice to have but not necessary for basic living.

Some common examples of needs and wants of students.

- Needs: Rent, utilities, groceries, textbooks.

- Wants: Dining out, concert tickets, brand-new gadgets.

Making a consistent distinction between needs and wants will help you save more money and avoid unnecessary spending.

For example, instead of buying coffee from a café every day, brewing at home can save a significant amount of money over time.

The Ruling on Saving When You Are Young

You know, it’s pretty relatable how every household feels that pinch when it comes to saving money, especially when you’re young.

It’s all about putting in the effort now so you can enjoy the fruits of your labor later on, right?

Building wealth takes time, but it’s definitely worth it in the long run!

Saving by far is the easiest way to build wealth over time.

Being young, saving is one of the most powerful financial habits you can adopt, even if you have a limited income.

This habit sets you up for future financial security and allows you to take advantage of the long-term benefits of smart budgeting and peace of mind.

Why Saving Matters, Even with Limited Income

It’s easy to think that saving is something you can put off until you’re earning more.

But saving even small amounts when you’re young can accumulate over time and help you prepare for both emergencies and future goals.

For example, imagine setting aside just ₹500 every month. Though it may not seem like much at first, over the course of a few years, that money adds up, and with interest or investment returns, it could become a substantial safety net.

This approach not only helps in the event of unexpected expenses (such as medical bills or car repairs), but also gives you a sense of control over your financial situation. It’s like building a cushion that protects you from falling into debt when the unexpected happens.

How to Start an Emergency Fund

An emergency fund is the cornerstone of good financial health.

This is a stash of money you keep aside for unexpected life events, and it should ideally cover 3-6 months’ worth of living expenses.

But as a student or young professional, starting with a smaller target (even one month of expenses) is an achievable goal.

To get started:

- Set a Goal: Calculate how much you spend each month on essentials (rent, utilities, food). This will be your target for your emergency fund.

- Start Small: Set aside a fixed amount every month, even if it’s as little as ₹1000. The key is consistency.

- Automate Savings: Automating your savings is a great way to make sure you’re consistently putting money away. Set up a recurring transfer from your checking account to a dedicated savings account as soon as your paycheck or income comes in.

Besides saving, there are plenty of other exciting things you can do, like building your credit and investing to help your money grow!

Let us address each one individually.

The Concept of Credit

Credit is an important financial tool that allows you to borrow money or make purchases using your credit cards.

Using these credit cards for your purchases can really help you boost your credit score!

What is a Credit Score and Why Does It Matters?

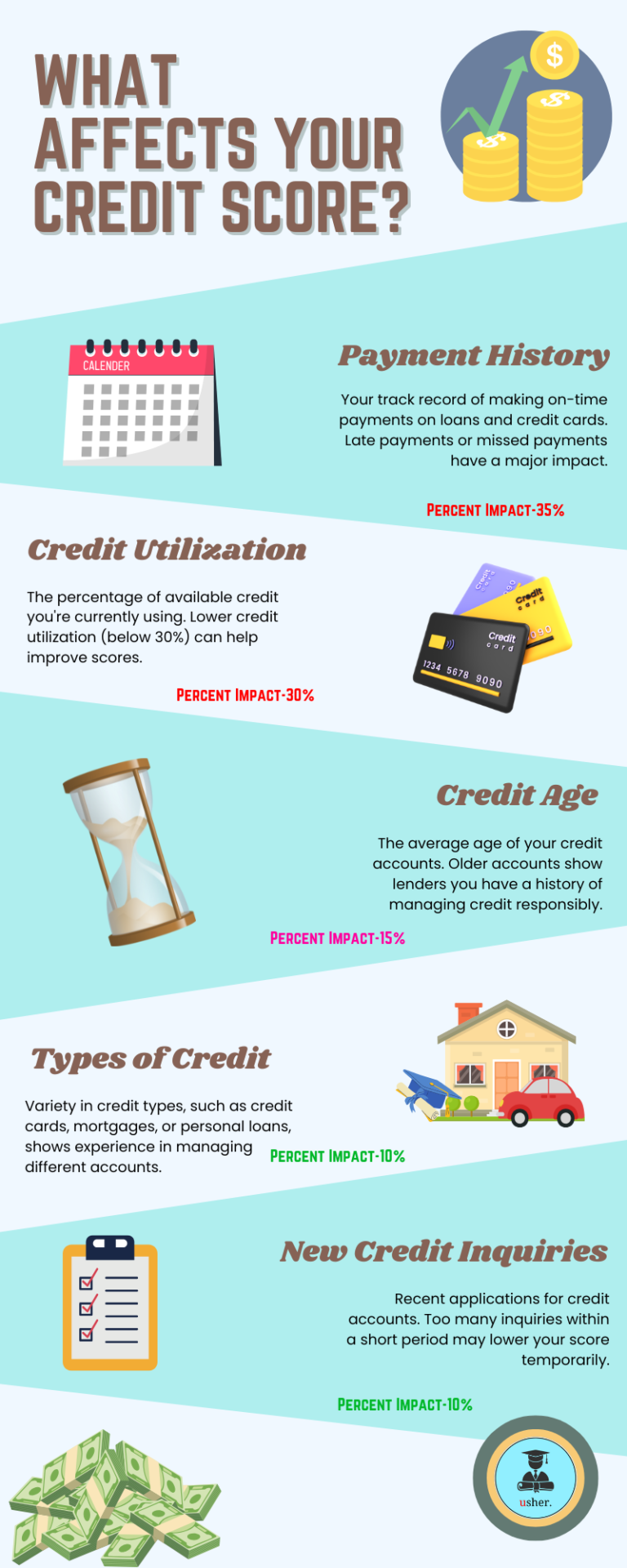

A credit score is essentially a grade given to you based on how well you manage your finances, particularly your debts.

It’s a number between 300 and 850, where higher numbers indicate better financial health.

This score is important because it affects your ability to borrow money in the future—whether for a student loan, a car, or even a house.

When you apply for a loan or credit card, lenders look at your credit score to determine how likely you are to repay what you borrow.

A higher score means you’ll qualify for lower interest rates, saving you money in the long run.

Even things like getting approved for a rental apartment or a mobile phone contract can depend on having a decent credit score.

In simpler terms:

Think of a credit score like a character’s reputation score in a video game. Just as a character earns or loses reputation based on their actions, your credit score reflects how well you handle money.

- Completing quests or missions (repaying loans on time) boosts your score.

- Failing quests (missing payments) lowers it.

- In games, high reputation unlocks new items or levels; similarly, a good credit score gives you access to better loans and lower interest rates.

Both systems reward consistency and penalize poor choices!

How to Build Credit as a Student

Building credit as a student can seem intimidating, but it’s not as hard as it sounds. The key is to start early and use credit responsibly.

Here are some easy steps to begin building your credit history:

- Get a Student Credit Card: Many banks offer student credit cards with lower limits and beginner-friendly terms. These cards are a good way to start building credit because they are tailored for people with little or no credit history.

- Pay Bills On Time: One of the biggest factors that impact your credit score is your payment history. If you pay your credit card or other bills (such as phone, rent, or utilities) on time every month, this will positively affect your credit score.

- Keep Your Credit Utilization Low: This refers to how much of your available credit you use. For example, if you have a credit limit of ₹50,000, try to use no more than 30% of that amount (₹15,000) to keep your credit utilization ratio low. This shows lenders that you’re responsible with your credit.

- Don’t Apply for Too Much Credit: Applying for too many credit cards or loans in a short time can negatively impact your credit score. Instead, focus on using one or two cards wisely.

Tips on Using Credit Responsibly

- Only charge what you can afford to pay off: Just because you have a credit card doesn’t mean you should max it out. Aim to use it for things you can afford to pay off at the end of the month.

- Pay more than the minimum: If you can, pay more than the minimum balance due on your credit card to avoid accumulating interest.

- Monitor your credit score: Use apps or services to regularly check your credit score and ensure there are no errors or issues.

The Concept of Investing

It seems like everyone and their grandma is chatting about investing these days, and you can bet every student is eager to get in on the action too!

Every time we scroll through social media, it feels like we’re being hit with a barrage of ads telling us that investing is the golden ticket to turning young folks into millionaires.

It’s like, “Hey, where’s my ticket?”

Jokes aside, investing has its own risks and rewards, and it’s important for you to educate yourself on the topic before diving in headfirst.

Understanding the factors that impact credit scores can also play a role in making informed financial decisions when it comes to investing.

Investing is like planting a money tree—if you start young and are ready to dig into the world of different investment options and strategies, you’re on your way to growing some serious wealth!

Why Investing Matters, Even When You’re Young

While saving money is essential, investing takes your financial health to the next level.

Investing allows your money to grow over time, thanks to the power of compounding interest. The earlier you start, the more time your money has to grow.

Even if you’re young and have a limited income, investing a small amount regularly can lead to significant returns over time.

For example, imagine you invest ₹5,000 a month starting at age 20. With an average annual return of 7%, you could have over ₹12 lakh by the time you’re 40. This is much more than what you would save if you simply put your money into a savings account.

Simple Investment Options for Students

- Index Funds: These are a type of mutual fund or exchange-traded fund (ETF) designed to track a specific market index, like the Nifty 50. Index funds are low-cost, easy to understand, and ideal for beginner investors because they diversify your investments across many companies.

- Robo-Advisors: If you’re not comfortable picking investments yourself, you can use a robo-advisor. These are online platforms that use algorithms to build and manage your investment portfolio based on your risk tolerance and goals. They usually charge low fees and are great for beginners.

- Recurring Investment Plans (SIPs): A Systematic Investment Plan (SIP) allows you to invest a fixed amount regularly into a mutual fund. It’s a great way to invest small amounts consistently and take advantage of market fluctuations.

Future Financial Planning for Students and Young Adults

Planning for the future might feel like something you can put off until after college or when you’re well into your career, but the reality is that thinking ahead financially, even in your youth, can set the foundation for a stable and successful future.

Here’s why future financial planning is critical and how you can get started.

Importance of Thinking Ahead: Career Planning and Post-College Life

The choices you make today directly impact your financial well-being after college. It’s important to start planning your career path early. This means not just choosing a major but also aligning your college activities (like internships and networking) with your long-term goals.

Early career planning helps you:

- Avoid unnecessary debt: When you have a clear career path, you can avoid unnecessary courses or degree changes that often result in extra student loans.

- Make better decisions about further education: Do you need graduate school, or would an entry-level job in your field give you the experience you need? Thinking about this early can help you plan your finances around education expenses.

- Prepare for post-college financial independence: While it’s common for students to rely on parental support, planning for life after graduation is essential. Building savings, learning to manage expenses, and planning for rent, groceries, transportation, and insurance can help you transition to financial independence smoothly.

Basics of Retirement Savings (Why Starting Early is Key)

Retirement might seem far off, but starting to save as early as possible can give you a huge advantage due to compounding interest. Even small contributions to a retirement account during college or your early career can grow significantly over time.

- Start with what you can: You don’t have to wait until you’re earning a full-time salary to start saving. Even if you can only contribute ₹1,000 or ₹2,000 per month to a Public Provident Fund (PPF) or other investment options, the power of compounding will make a massive difference over time.

- Employer-Sponsored Retirement Plans: Once you start working, look into employer-sponsored retirement plans like the Employees’ Provident Fund (EPF) or any other retirement investment options offered by your employer. These accounts often come with matching contributions, which means free money toward your retirement.

- Why Starting Early Matters: Imagine investing ₹5,000 per month at age 20 with an annual return of 8%. By age 60, you’d have over ₹1.6 crore. Starting just 10 years later, at age 30, would give you only around ₹70 lakh. The earlier you start, the more time your investments have to grow.

The Role of Internships and Side Hustles in Improving Financial Security

Internships and side hustles are not only great for gaining experience and building your resume, but they can also significantly improve your financial security during and after college.

- Internships: Not only do internships give you hands-on experience, but many paid internships allow you to start earning an income. This money can be used to start an emergency fund, save for post-college expenses, or invest in small amounts.

- Side Hustles: Whether it’s freelancing, tutoring, or working part-time, a side hustle allows you to diversify your income streams. This extra money can go toward paying off student loans faster, investing in your future, or simply building financial independence.

Example: Let’s say you’re tutoring high school students in your free time and earning an extra ₹10,000 per month. You can use this money to create an emergency fund, contribute to savings, or invest in mutual funds, all of which will give you greater financial flexibility in the future.

Tools and Resources for Student Financial Management

Managing finances as a student can be overwhelming, but the right tools and resources can make a big difference. Here’s a list of useful apps, books, podcasts, and websites to help students stay on top of budgeting, saving, and investing.

Top Apps for Budgeting, Investing, and Debt Management

- Mint – Mint is a free budgeting app that connects to your bank accounts and automatically categorizes your spending. It offers visual breakdowns of expenses and tracks bills to help manage personal finances easily.

- YNAB (You Need a Budget) – You Need a Budget app helps students focus on proactive budgeting. It allows you to set financial goals, track every rupee spent, and allocate money to different spending categories.

- Wally – Wally is a great app for tracking daily expenses. Its simple interface allows users to set spending limits and visualize where their money is going.

- Groww – For students interested in dipping their toes into investing, Groww is a beginner-friendly platform that makes it easy to start investing in mutual funds and stocks.

- CRED – For students with credit cards, CRED helps manage and pay credit card bills on time, rewards users with points, and provides a credit score overview.

- Splitwise – Perfect for students living with roommates or splitting costs with friends. Splitwise helps track shared expenses and balances payments easily.

Best Books for Financial Literacy

- “Rich Dad Poor Dad” by Robert Kiyosaki – A classic that offers insights into how the rich think about money, assets, and investments. A must-read for students wanting to change their financial mindset.

- “I Will Teach You To Be Rich” by Ramit Sethi – This book breaks down personal finance into actionable steps, from budgeting and savings to investing and automating finances.

- “The Psychology of Money” by Morgan Housel – This book explains how emotions and psychology drive financial decisions. It’s great for students looking to understand the mindset behind managing money effectively.

- “The Barefoot Investor” by Scott Pape – Ideal for beginners, this book provides simple financial advice on budgeting, investing, and eliminating debt in a straightforward manner.

Also read: Top Books Every Student Must Read

Top Financial Literacy Podcasts

- The Dave Ramsey Show – A popular podcast focusing on paying off debt, budgeting, and building wealth through practical financial advice.

- BiggerPockets Money – This podcast covers real-life stories from people who have mastered personal finance and offers tips on managing money and investing.

- The Indian Dream Podcast – While focused on entrepreneurship, this podcast also covers important financial topics like investments and personal finance tailored to young Indian listeners.

- The Financial Confessions – This podcast breaks down the stigma around discussing money and offers tips on navigating personal finance for young adults.

Best Websites for Learning Financial Literacy

- Investopedia – A comprehensive financial education site that breaks down complicated financial terms and concepts in simple language. It covers everything from budgeting to investing and retirement.

- NerdWallet – This site provides up-to-date financial advice, including student loan tips, budgeting strategies, and investing basics.

- Moneycontrol – A useful Indian financial website that helps students stay informed about stocks, mutual funds, and other investment opportunities.

- Rupeevest – A resource for students interested in investing. It offers information on mutual funds, stock markets, and other investment products in India.

Also read: 5 Most Essential Parts Of Student Life

Conclusion

Mastering financial management as a student is one of the most powerful ways to ensure future success. By learning how to budget, save, invest, and manage credit early on, you are setting yourself up for long-term financial stability and independence.

The key is to start small but stay consistent.

You don’t need to be a financial expert overnight; even setting aside a small amount each month can lead to big changes over time.

To stay motivated, consider tracking your financial progress. Set realistic goals for saving, budgeting, and investing, and make use of the tools and resources mentioned.

Join a financial literacy community or follow finance experts on social media to stay updated with tips and strategies.

Your financial future starts now—take control and see the rewards unfold!

All the Best!